Get instant quotes, compare top carriers, and secure coverage today – all without a medical exam.

Get the life insurance protection you need without the hassle of a medical exam. At Golden Age Marketing, we offer a quick and convenient way to secure your family’s financial future. No doctor’s visits, no blood tests, just a simple application process.

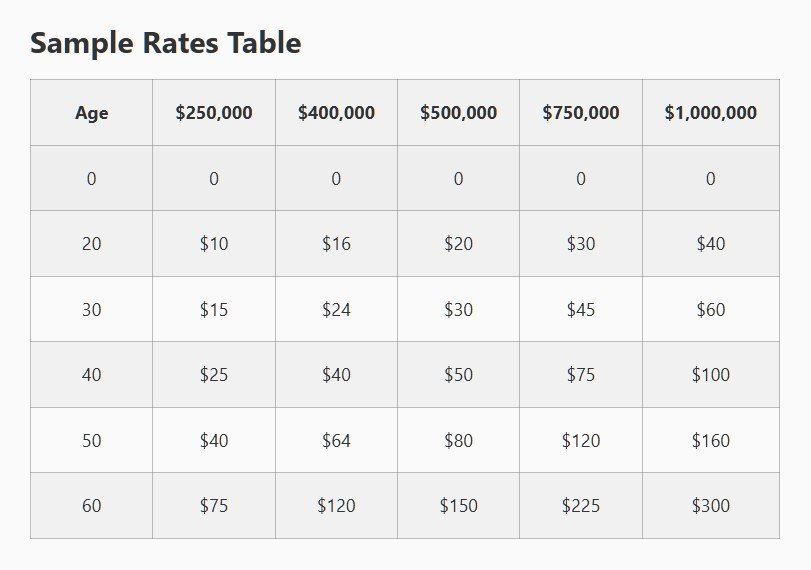

| Age | $250,000 | $400,000 | $500,000 | $750,000 | $1,000,000 |

|---|---|---|---|---|---|

| 0 | 0 | 0 | 0 | 0 | 0 |

| 20 | $10 | $16 | $20 | $30 | $40 |

| 30 | $15 | $24 | $30 | $45 | $60 |

| 40 | $25 | $40 | $50 | $75 | $100 |

| 50 | $40 | $64 | $80 | $120 | $160 |

| 60 | $75 | $120 | $150 | $225 | $300 |

Worried about expensive medical exams and lengthy underwriting? With our no-exam term life insurance, you can get the coverage you need at a price you can afford. Check out these sample rates to see how much you could save!

These are illustrative rates for no-exam term life insurance. Your actual premium will depend on various factors, including your health history, lifestyle, and chosen coverage amount.

These sample rates are averaged across genders for simplicity. Typically, females secure lower premiums than males due to longer life expectancy.

Excellent health and a healthy lifestyle can lead to lower premiums. Factors like smoking, certain medical conditions, or high-risk hobbies can increase costs.

The type of no-exam policy (simplified issue, guaranteed issue, etc.) influences the premium. Guaranteed issue policies generally have higher premiums.

No-exam life insurance is a type of life insurance policy that allows you to skip the medical exam typically required for traditional life insurance. Instead, the application process involves answering a few basic health questions.

When you apply for no-exam life insurance, you’ll complete an application form, which may include questions about your health, lifestyle, and medical history. Some policies may use data from medical records or prescription history to evaluate your eligibility. Once approved, your coverage begins, often within days.

Term Life Insurance: Provides coverage for a specific period, such as 10, 20, or 30 years.

Whole Life Insurance: Offers lifelong coverage with a cash value component.

Guaranteed Issue Life Insurance: Requires no health questions or exams, ideal for individuals with significant health concerns.

You’ll typically need to provide:

Reputable insurers disclose all fees and costs upfront. Be sure to review the policy documentation carefully and ask your provider about any fees you’re unsure of.